Texas Lawmakers Consider Creating Gold-Based Digital Currency for Use by Anyone Anywhere

Texas could become the first state in the nation to issue its own digital currency based on gold and silver.

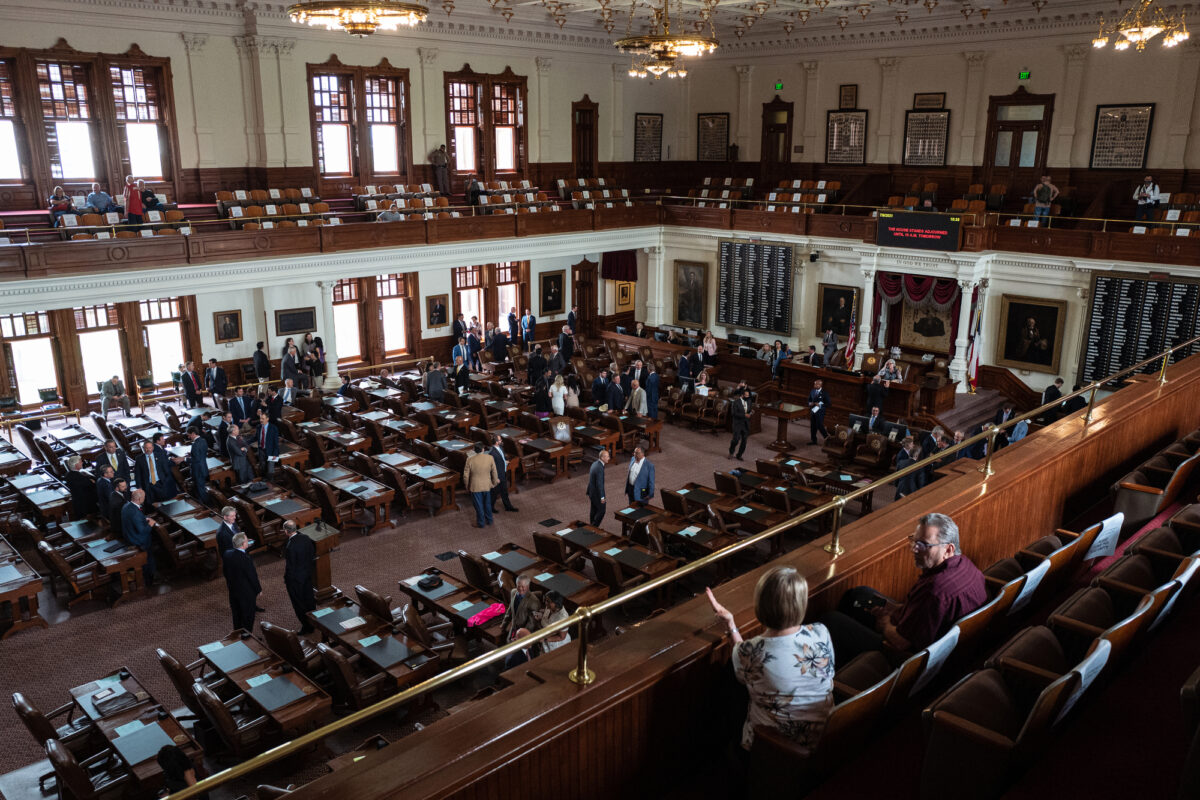

The Texas Senate could vote on Senate Bill 2334 this week. A similar bill in the Texas House, House Bill 4903, did not advance.

If the Texas digital currency proposal becomes law, money could be spent with a debit card by people anywhere in the world, not just within Texas.

The measure would create an alternative to a federal digital dollar, an idea currently being considered by the federal government because of a directive by President Joe Biden.

Some conservatives have said they fear a federal digital dollar could be manipulated by the U.S. government and used to spy on account owners, possibly controlling how and when they can spend their money.

In today’s society, gold is not always easy to trade for cash.

But Lone Star Tangible Assets, the operator of the TBD, has relationships with well-known commercial bullion banks and investment banks that are capable of providing liquidity for gold owners, according to the company’s website.

TBD offers liquidity on the scale of COMEX, the Commodity Exchange Inc., a major platform for metals trading, according to its website.

The legislation would allow the state to charge transaction fees, similar to those charged by credit card companies and banks. Any profit from those fees would go into the Texas general fund.

Why It’s Legal

The U.S. Congress has the power to coin money and regulate its value. But states also can make their own gold and silver coins, as authorized by Section 10, Article 1 of the U.S. Constitution.

The Texas bill’s sponsor, Republican Sen. Bryan Hughes, said that inflation, bank failures, and the specter of a Central Bank Digital Currency (CBDC) are financial issues that worry Texans.

“We know that the dollar, of course, lost more value last year—in 2022—than any year since 1980,” Hughes said during a hearing on the bill.

The proposed plan for digital currency in Texas based on gold and silver is “a hedge against inflation, a signal to the Feds that their digital dollar will not control us, and another way to pay at a very basic level,” Hughes said.

Kevin Freeman, an investment expert for 40 years who spoke during an April hearing on the bill, said Texas could dominate the digital currency market, if it becomes the first state to create a workable plan.

Freeman, the host of the Economic War Room podcast, told The Epoch Times that the Texas plan would operate in a way similar to Glint Pay, a London-based payment platform.

Glint Pay purchases gold and holds it in Switzerland for users. The gold owned by each user is tied to a debit card.

When the debit card is used to make a purchase, Glint converts the money, based on the current value of the gold in the user’s account, into the merchant’s local currency and deducts the total from the user’s account balance.

As the value of the held gold fluctuates, so does the value of each user’s account.

Tax and Privacy Implications

The downside to Glint Pay is that people must report and pay taxes on capital gains on gold transactions because those associated with the program are considered private sales of gold, Freeman said.

The Texas bill would allow the state to make its digital currency and coins legal tender, eliminating the need to pay capital gains taxes, he said.

Other states have made silver coins as legal tender, but the coins didn’t function as money that could be used in transactions.

“This is the first bill in modern times that addresses all of the issues and problems,” Freeman said.

Some people may worry that the value of their gold held in the digital currency account would fluctuate, he said.

It’s true that the worth of precious metals rises and falls daily, said Freeman, but that’s true of the dollar, too, which has also lost value due to inflation.

China is attempting to unseat the U.S. dollar as the world’s reserve currency and the U.S. government is exploring the use of CBDC. Those are reasons for Texas to act now, Freeman said.

Having a digital currency option based in Republican-controlled Texas could allay some conservatives’ fears.

Texas is the second most-populous state. Republicans hold every statewide office and hold majorities in the state House and Senate. Republicans hold both of the state’s U.S. Senate seats, and the Texas Supreme Court is considered conservative.

Banks with “progressive” corporate values have already de-platformed conservatives, Freeman pointed out. And payment platforms such as PayPal made news for wanting to fine people—mostly those expressing conservative opinions—for spreading “misinformation” in October 2022.

PayPal’s policy would have allowed it to fine users $2,500 for promoting “misinformation.” The company later said the policy was an error.

The Texas bill that would create digital currency has specific language that bars the Texas Legislature from appropriating the funds held in trust by the Texas Bullion Depository.

Biden’s Digital Dollar

Biden’s 2022 executive order instructed the federal government and Federal Reserve to explore the potential for a new U.S. currency, a digital dollar.

The president called on the National Science Foundation to investigate the “socio-technical” aspects of a digital dollar so that it would be “inclusive, equitable, and accessible.”

A government report noted that the central bank might “limit the amount of CBDC an end user could hold.”

That led some to worry that the government could control or limit the use of a federal digital dollar.

The Federal Reserve’s CBDC study said the system would benefit the government because it could either slow down or speed up the economy, Freeman said.

One way would be to freeze people’s bank accounts or put expiration dates on funds like manufacturer coupons, he said.

Biden’s digital dollar could be programmable. Freeman said banks could limit how much gasoline people could buy monthly, for example.

CBDC could also be used as a “virtual lockdown,” Freeman said.

“They can say to an individual: ‘You’re not allowed to exit your zip code. You’re trying to spend money outside of your 15-mile radius,’” he said.

Some have worried that having the right “social credit score” could become a requirement for using digital currency.

Citing that concern, Gov. Ron DeSantis (R) signed into law on May 12 a measure that bans central bank digital currency (CBDC) in Florida.

Comments (0)