Millennials and Gen Zers ditch ‘woke capitalism’: Support plummets for socially-conscious ESG funds as TikTokers bash ‘scam’ diversity targets and ‘greenwashing’

Story by James Reinl, Social Affairs Correspondent, For Dailymail.Com

Millennials and Gen Zers are famous for urging businesses to lead the way on making society fairer, workplaces more diverse, and cutting emissions of planet-heating gases.

That could be changing — and fast.

Research shows that younger investors are turning their backs on firms that tout trendy environmental, social, and governance (ESG) efforts — which is often mocked as ‘woke capitalism.’

A survey of some 1,000 investors found that millennial and Gen Z respondents had started to allocate their money more like baby boomers, who are keener on turning a profit than lofty principles.

It comes as social media influencers discuss ESG on TikTok and question whether it makes good returns or amounts to little more than greenwashing.

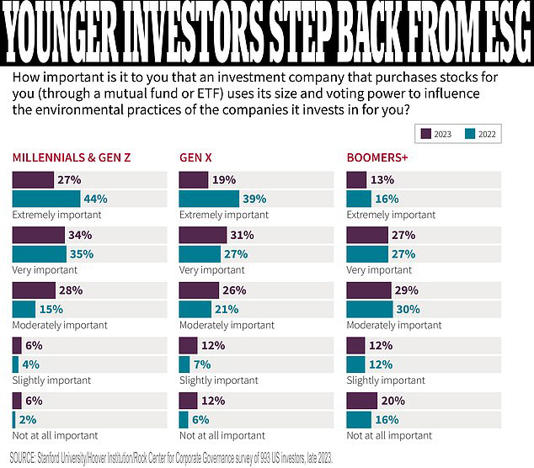

Prof David Larcker, of Stanford Graduate School of Business, who led the research, said support for ESG values among younger investors fell by ‘double-digit percentages’ between 2022 and 2023.

Previously, young investors said they were ‘very concerned about environmental and social issues’ and wanted their fund managers to push ‘for change, even if it meant a loss of personal wealth,’ said Larcker.

That ‘sentiment has changed dramatically,’ he added.

In the survey, preference for ESG investing among millennials and Gen Zers, who are aged between 18 and 41, fell sharply.

The share of those who said they were ‘very concerned about environmental issues’ dropped from 70 percent in 2022 to 49 percent last year.

The share of those who were worried about social issues fell from 65 percent to 53 percent.

Meanwhile, those concerned about social issues dropped from 64 percent to 47 percent, according to the study from Stanford University, the Hoover Institution, and the Rock Center for Corporate Governance.

The share of millennial and Gen Z investors who said they wanted their fund managers to promote ESG values also tanked — from nearly half of them in 2022 to about a quarter last year.

Their investment preferences became much closer to those of baby boomers, researchers said.

The trend comes as millennial and Gen Z TikTok users who share financial advice on the platform express unease about ESG.

The user known as @kathildahill this month asked followers whether socially conscious investing amounted to ‘scam.’

Another finance influencer, @commonstock, warned profit-seekers not to get duped.

‘ESG is mostly a marketing term that funds use to try and convince investors that they are investing in good companies,’ he said.

‘Don’t fall for it.’

ESG refers to a set of standards for a firm’s behavior that guide investors on where to put their money — for example, by funding wind farms to combat climate change, while pulling out of harmful oil and tobacco giants.

The strategy gets more controversial when it guides funding to firms promoting diversity, equity, and inclusion (DEI) schemes, which irk conservatives, who say they help women and minorities by sidelining white men.

This has spawned a fractious debate about whether efforts to make society fairer and cut carbon emissions are in the strategic interest for investors, by mitigating the risks of climate chaos and social disorder.

ESG investing boomed in the pandemic, when lockdowns caused energy prices to fall and buoyed portfolios that shunned fossil fuels.

Those same strategies have floundered as lockdowns ended and economic activity resumed.

Sustainable funds faced a sharp slowdown in demand globally last year, even though they outperformed other funds thanks in part to their inclusion of technology stocks, which performed well.

Globally, funds classified as ‘responsible investing’ recorded $68 billion of net new deposits in 2023 through November 30, LSEG Lipper data showed.

That was down sharply from $158 billion for all of 2022 and from $558 billion for all of 2021.

Prof Amit Seru of Stanford Graduate School of Business, another researcher involved in the opinion survey, said younger investors used to be ‘bedrock advocates’ of socially-conscious investing.

Now ‘they are much less willing to lose personal money to see progress made against issues such as climate change, sustainability, labor conditions, and diversity in the workplace,’ said Seru.

‘With their confidence down, investors are more cautious about risking their personal wealth to support stakeholder issues.’

Comments (0)